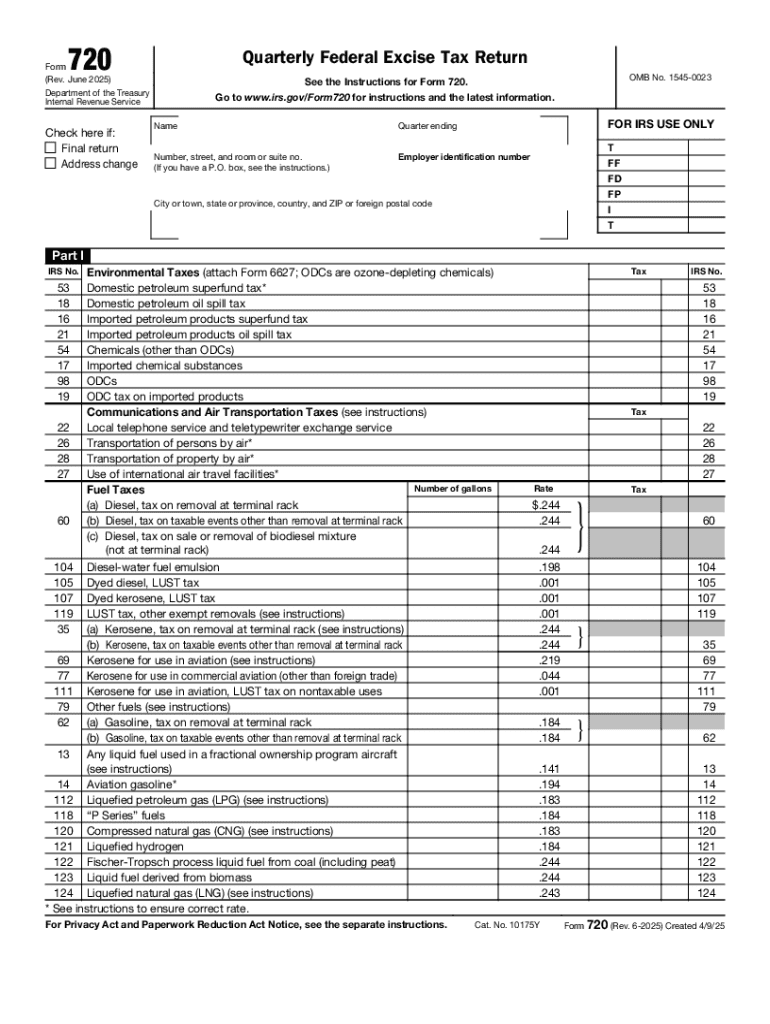

IRS 720 2025-2026 free printable template

Instructions and Help about IRS 720

How to edit IRS 720

How to fill out IRS 720

Latest updates to IRS 720

All You Need to Know About IRS 720

What is IRS 720?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 720

What should I do if I discover an error after submitting my IRS 720?

If you find a mistake on your IRS 720 after submission, you can file an amended form to correct it. Ensure all necessary corrections are made, and attach any required documentation that supports the amendment. Keep copies of both the original and the amended form for your records.

How can I check the status of my submitted IRS 720?

To verify the status of your IRS 720, you can log into your e-filing account or contact the IRS directly. If you received a confirmation after submitting electronically, this indicates your form was received, but for processing updates, you may need to wait for additional feedback from the IRS.

Are e-signatures accepted on my IRS 720 submission?

Yes, e-signatures are generally accepted when filing the IRS 720 electronically. Make sure your e-signature complies with IRS guidelines to ensure that your submission is valid and processed without issues.

What common mistakes should I avoid when filing my IRS 720?

One common error is not double-checking the accuracy of the information provided, which can lead to rejections or amendments. Additionally, ensure that you are using the most current version of the form and that all required fields are filled out correctly.

What happens if I receive a notice from the IRS after filing my IRS 720?

If you receive a notice from the IRS following your IRS 720 submission, carefully read the notice for specific instructions. Depending on the nature of the correspondence, you may need to provide additional documentation or clarify the information submitted.

See what our users say